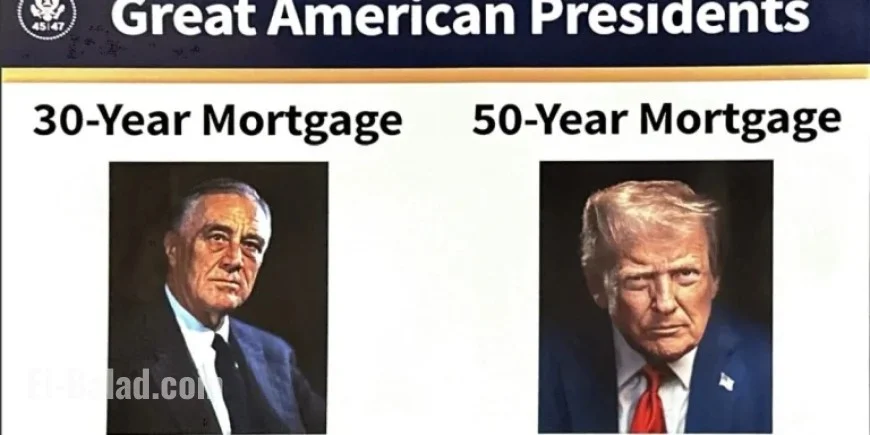

Trump Administration Proposes 50-Year Mortgage to Ease Housing Market Gridlock

The Trump administration is set to introduce a 50-year fixed-rate mortgage as a potential solution to the ongoing housing market difficulties. Officials believe this reform could help millions of Americans facing challenges with home affordability. The announcement was made by Federal Housing Finance Agency Director Bill Pulte, who emphasized the significance of this proposal in alleviating the housing crisis.

Understanding the 50-Year Mortgage Proposal

This proposal aims to make homeownership more attainable by extending the duration of mortgage payments. A longer amortization period is expected to lower monthly costs for homeowners.

Comparison of Mortgage Options

For example, consider a $400,000 home with a 6.575% interest rate and a 20% down payment:

- 30-year fixed mortgage: $2,788 monthly payment

- 40-year fixed mortgage: $2,640 monthly payment

- 50-year fixed mortgage: $2,572 monthly payment

These figures suggest that the proposed 50-year mortgage could lower monthly payments, potentially increasing accessibility for first-time homebuyers.

Current Housing Market Challenges

The housing market has faced significant hurdles, including high costs that keep many potential buyers out. Currently, the median American household spends about 39% of its income on mortgage repayments, exceeding long-term affordability benchmarks.

The “lock-in effect” has also exacerbated the situation. Many homeowners are reluctant to sell due to the ultra-low interest rates they secured before rates rose in 2022. This reluctance has contributed to a stagnant housing market.

Effects of Rising Interest Rates

High mortgage rates have led to a surge in demand for adjustable-rate mortgages, which now constitute over 10% of new applications, the highest rate since 2021. Critics of the 50-year mortgage proposal warn that although it may lower monthly payments, it could also lead to increased house prices and slow the growth of home equity, keeping borrowers in debt longer.

The Broader Implications

The average age of first-time homebuyers has climbed to 40 years, the highest recorded. As noted by the National Association of Realtors, this statistic indicates that new buyers are closer to retirement age than their high school graduation.

Moreover, Pulte mentioned plans for Fannie Mae and Freddie Mac to take equity stakes in private companies, aiming to utilize these resources to improve the housing market.

Conclusion

The proposed 50-year mortgage by the Trump administration is positioned as a potential remedy for the current housing market gridlock. However, experts raise valid concerns about the long-term financial implications for borrowers. As the administration continues to develop solutions, the effectiveness of this proposal remains to be seen.