Brazil Central Bank Closes Banco Master; Police Arrest Top Investor

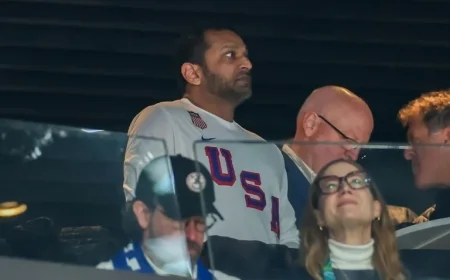

Brazil’s central bank has taken decisive action to close Banco Master, a mid-sized lender facing significant liquidity challenges. The closure took place amid the arrest of Daniel Vorcaro, the bank’s controlling shareholder, by federal police.

Banco Master’s Closure and Liquidation

Banco Master has struggled with mounting liquidity issues, prompting the central bank to appoint a liquidator for the bank. This individual will oversee creditor claims and the sale of the bank’s assets. Finance Minister Fernando Haddad underscored the thoroughness of the regulatory review that led to the bank’s closure.

Police Action and Arrests

In a separate but related operation, Brazilian federal police targeted the issuance of fraudulent credit securities by financial institutions. Reports indicate that Vorcaro’s arrest is linked to this broader investigation, which aims to secure 12.2 billion reais (approximately $2.28 billion) related to the bank’s operations.

- Arrested Individual: Daniel Vorcaro, controlling shareholder of Banco Master

- Target of Investigation: Issuance of fraudulent credit securities

- Frozen Assets: 12.2 billion reais ($2.28 billion)

Issues with BRB and Leadership Changes

As part of the investigation, Paulo Henrique Costa, the CEO of BRB (Banco de Brasília), has been temporarily suspended from his role. This suspension follows the bank’s attempt to acquire assets from Banco Master, which was blocked in September by the central bank. The decision was made after a comprehensive assessment of BRB’s financial capacity.

Details of the Investigation

Federal police executed search and seizure warrants at BRB’s headquarters, indicating the depth of the inquiry into potential misconduct. In a statement, BRB affirmed its commitment to transparency and stated that it continues to operate normally.

Future of Banco Master

The situation for Banco Master appeared to pivot when a consortium, led by Brazilian investment group Fictor along with unnamed investors from the UAE, expressed interest in acquiring a significant stake in the bank. This proposed transaction included an immediate capital injection of 3 billion reais.

- Proposed Acquisition: Led by Brazilian investment group Fictor

- Capital Injection: 3 billion reais

Banco Master had previously marketed its high-yield debt as protected by the FGC deposit insurance fund, which insures up to 250,000 reais ($46,926) per investor. As Banco Master enters liquidation, the appointed administrator will compile a list of the bank’s creditors and facilitate compensation to insured investors through the FGC.