Canada’s Crypto Tax Crackdown Faces Delays

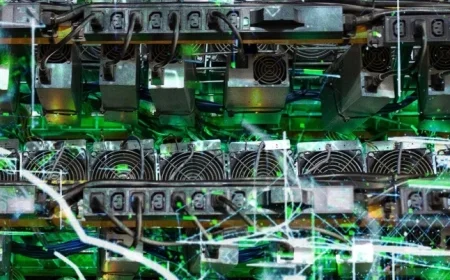

Recent developments involving a Vancouver-based crypto firm reveal challenges in Canada’s efforts to address crypto tax evasion and illicit financing. The Canada Revenue Agency (CRA) has filed an application in Federal Court, citing concerns over taxpayers exploiting the anonymous nature of crypto transactions to avoid taxes.

Challenges in Enforcement of Crypto Taxation

The CRA’s top auditor notes that identifying taxpayers operating in the crypto space is a significant obstacle. This inadequacy hampers their ability to gauge compliance with income tax requirements effectively. In a recent affidavit, the agency indicated that the trend of using cryptocurrencies and non-fungible tokens (NFTs) for tax evasion is growing.

Targeting High-Risk Crypto Users

As part of its efforts, the CRA sought to uncover the identities of 2,500 clients from Dapper Labs Inc., a leading player in the non-fungible token market. While the company cooperated, negotiations significantly reduced the initial inquiry from 18,000 users. This marks only the second time a Canadian court has mandated the identification of customers in a tax evasion investigation.

Tax Compliance Statistics

- Approximately 15% of Canadian taxpayers using crypto platforms have failed to file taxes on time.

- 30% of those who file returns are considered high-risk for non-compliance.

According to the CRA, the COVID-19 pandemic has exponentially increased crypto asset usage, complicating compliance due to the inherent anonymity of these transactions.

CRA’s Audit Program and Investigations

The CRA currently employs 35 auditors specifically for crypto-related investigations, managing over 230 cases. These efforts have yielded approximately $100 million in additional tax revenue from audits in the last three years. The agency has launched five criminal investigations related to digital assets since 2020, with four ongoing as of March 2025, but no charges have been filed to date.

Understanding Regulatory Frameworks

Jessica Davis, an expert in illicit financing, noted the significance of the $100 million collected through audits. Despite the absence of criminal charges so far, she emphasizes the growing awareness of tax obligations in the crypto sector. Canada’s regulatory framework is robust; however, the enforcement aspect remains a challenge. Resources for financial crime investigations are often diverted to other priorities.

Recent Penalties for Non-Compliance

This year, Canada’s anti-money laundering agency, FINTRAC, has imposed serious penalties on several crypto companies for regulatory non-compliance. Key penalties include:

- Nearly $177 million against Xeltox Enterprises Ltd.

- More than $19.5 million against Peken Global Ltd. (operating as KuCoin)

Neither company has Canadian operations but is contesting the penalties in Federal Court.

Conclusion

Canada’s approach to regulating crypto assets is evolving. While the CRA is making strides in revenue collection, the complexities of enforcement present significant hurdles. Continued efforts will be essential to ensure compliance in this rapidly changing landscape.